Introduction: The cannabis industry has experienced a significant surge in recent years, attracting investors from all corners of the globe. As the market continues to grow, many investors are seeking ways to gain exposure to this burgeoning sector. One of the most popular and convenient methods is through investing in a US cannabis stock ETF. This article aims to provide a comprehensive guide to understanding US cannabis stock ETFs, including their benefits, risks, and key considerations.

What is a US Cannabis Stock ETF? A US cannabis stock ETF, or exchange-traded fund, is a type of investment vehicle that tracks the performance of a basket of cannabis-related stocks. These funds are designed to provide investors with a diversified and accessible way to invest in the cannabis industry without having to select individual stocks. By purchasing shares of a cannabis stock ETF, investors can gain exposure to a variety of cannabis companies, including growers, processors, and retailers.

Benefits of Investing in a US Cannabis Stock ETF

Risks of Investing in a US Cannabis Stock ETF

Key Considerations When Investing in a US Cannabis Stock ETF

Case Study: AdvisorShares Pure Cannabis ETF (YOLO) One popular US cannabis stock ETF is the AdvisorShares Pure Cannabis ETF (YOLO). This ETF tracks a basket of cannabis companies and has gained a significant following due to its focus on pure-play cannabis companies. Since its launch in 2016, YOLO has experienced significant growth, highlighting the potential of investing in a cannabis stock ETF.

Conclusion: Investing in a US cannabis stock ETF can be a viable option for investors looking to gain exposure to the cannabis industry. However, it's crucial to conduct thorough research and consider the risks and benefits before making an investment. By understanding the intricacies of these funds, investors can make informed decisions and potentially capitalize on the growth of the cannabis market.

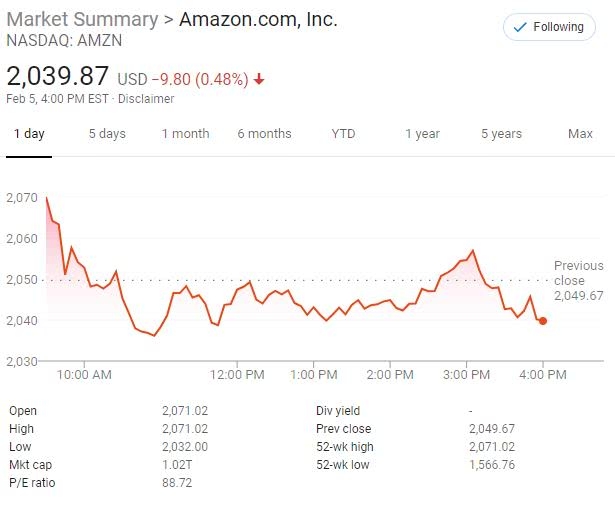

nasdaq composite